Tax Rates

If you are required to collect taxes for your products or services, you can enter applicable tax rates at Setup > Advanced > Tax Rates:

The above example shows a 5% tax rate for products and a 3% tax rate for services for all online orders shipping to Massachusetts. (Note: This is just an example; it is not intended to reflect the correct tax rates for Massachusetts.)

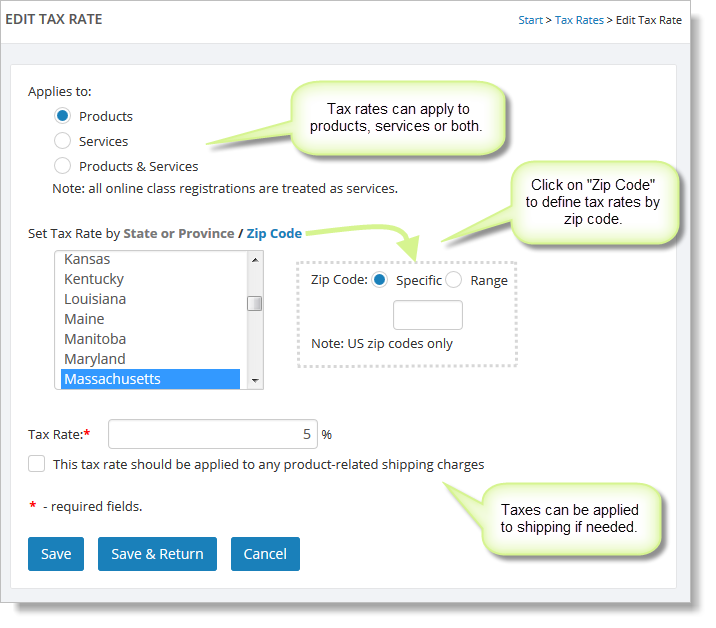

To edit or delete a tax rate, hover over it and click the blue down arrow on the far right. This action displays a drop-down list with both the "Edit" and "Delete" commands. You can also edit a tax rate by clicking its ID in the far left column. This action takes you to Edit Tax Rate (shown below).

Click the "Add" button to add a new tax rate. You will be presented with a form to fill out. Enter the information about the tax rate and click the "Save & Return" button to add the tax rate to the list.

A single tax rate can apply to products, services or both. Online registrations are always considered services when tax rates are being applied.

Tax rates can apply to all states and provinces or a particular state or province. Tax rates can also apply to a single zip code or range of zip codes. Click on "Zip Code" to activate the zip code option.

Tax rates can be applied to shipping charges as well.